Weekly Market Commentary April 22nd, 2020

The Markets

Last week’s economic data was about what you might expect in the midst of a virus crisis that has shut down businesses and forced people to stay home:

· American retail sales numbers were down 8.7 percent in March. Retail sales track demand for everything from clothing to refrigerators. The March decline was the worst monthly performance on record, according to Ben Levisohn of Barron’s. Statistics Canada has not yet released March numbers, but they are likely going to be in the same ballpark as the American numbers.

· Oil prices fell further. Saudi Arabia, Russia, and other nations agreed to reduce oil production, but that may not be enough to steady prices. The Economist explained, “Global demand may fall by 29 [million] barrels a day this month, three times the OPEC deal’s promised cuts.”

· Earnings season began with a whimper. Just a sliver (9 percent) of the companies in the S&P 500 index have reported first quarter earnings. So far, blended earnings (actual results for companies that have reported plus estimated results for companies that have not) are down 14.5 percent for the first quarter, reported John Butters of FactSet.

There were some bright spots, though, that boosted optimism in financial markets.

New York, which has been hit worse than anywhere else in North America, with more than 13,000 residents losing their lives as a result of the coronavirus, may be entering a period of deceleration. The number of hospitalizations and deaths moved lower late last week, reported MarketWatch.

Germany announced it is slowly beginning to reopen shops and schools. Guy Chazan of Financial Times reported, “Germany has managed to contain coronavirus more effectively than other European countries, partly thanks to a comprehensive testing regime that allowed authorities to identify and isolate those infected with the virus at an early stage. It has the capacity to run 650,000 tests a week.”

Outside of Ontario and Quebec, aggressive social distancing measures have been largely successful in Canada, with most provinces successfully flattening the curve enough to avoid overloading the medical system.

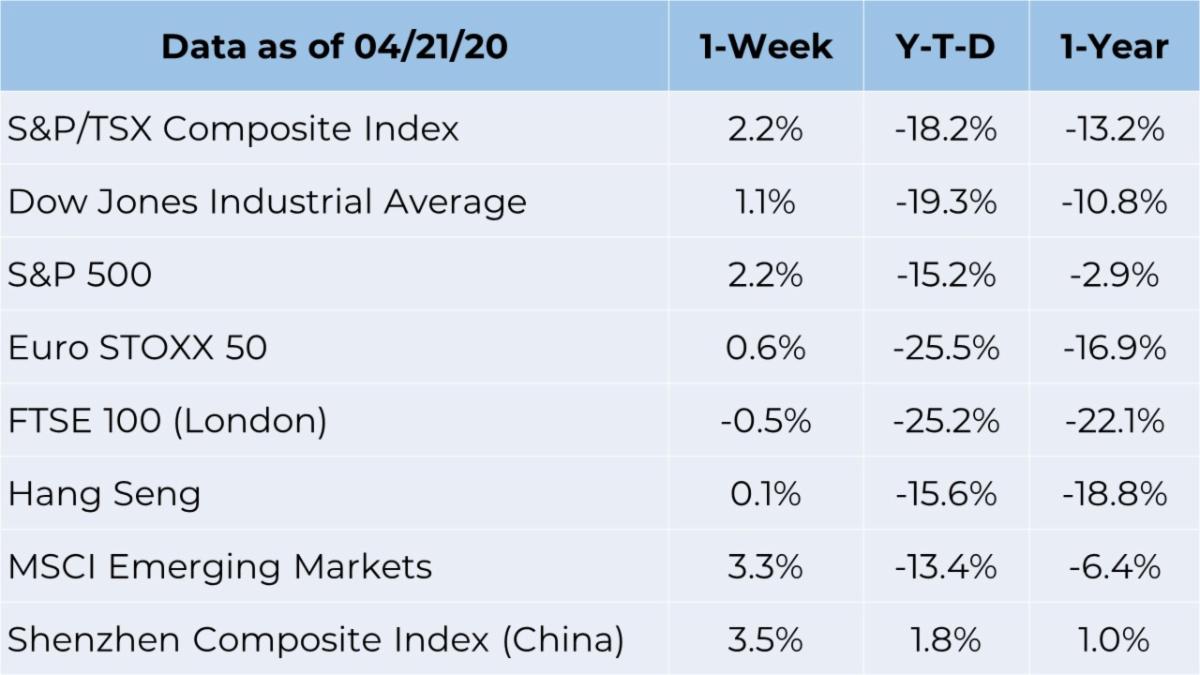

Major North American stock markets moved higher last week and expectations for future volatility moved lower, but uncertainty remains high. If you are concerned about your investment portfolio or current market conditions, please don’t hesitate to reach out to us.

Source: Refinitiv

Five things to do if you lost your job

During the past four weeks, millions of North Americans have filed for unemployment benefits. It’s an enormous number that reflects the staggering magnitude of job losses due to the coronavirus.

Job loss is painful in any circumstances. It’s particularly intimidating when it occurs in the midst of a pandemic and economic downturn. If you are recently unemployed, here are five things you can do:

- Review your health insurance options. You may have the option to keep your employee health plan for a period of time. It’s temporary and it can be expensive. You pay the entire premium, including the amount your employer used to pay. It may be less expensive to join a spouse’s plan, if that is an option. Another alternative is to purchase a plan through a third party.

- Get financial advice. We’ll help you evaluate your financial position by reviewing monthly expenditures and available cash, so you know how long you can make ends meet with current financial resources.

It may be possible to reduce monthly spending relatively quickly. Banks, credit card companies, utilities and other institutions are allowing customers who call to defer payments because of COVID-19 shutdowns. - File for unemployment benefits. Ratchet up your patience. The sheer number of applicants has overwhelmed unemployment benefit systems. Completing online forms and applying for relief payments can take a significant amount of time, so file as soon as you can and be patient.

- Update your resume and LinkedIn profile. Revamp your resume. Polish your LinkedIn profile. Make sure your profile is ‘public’ so people can find you. Join groups that share your interests and passions. Learn more about companies you may want to join.

- Reach out. Start connecting with friends and colleagues. Let them know you are looking for your next opportunity.

Consider doing volunteer work or freelancing until you find a new position. Work of any kind will help you stay busy during the times you’re not hunting for a new job.

Weekly Focus – Think About It

“Far and away the best prize that life offers is the chance to work hard at work worth doing.”

--Theodore Roosevelt, 26th American President

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager