Weekly Market Commentary August 5 2020

The Markets

Last week delivered a mixed bag of financial and economic news.

As many expected, the U.S. and Canadian economies did not fare well during the second quarter. Coronavirus lockdowns and business closings caused productivity to fall by roughly one-third. U.S. real gross domestic product, which is the value of all goods and services produced by a country, dropped 32.9 percent during the second quarter of 2020, reported the Bureau of Economic Analysis. During the first quarter of the year, productivity fell by 5 percent.

As is typical, the Bank of Canada has not yet released data on how badly the Canadian economy contracted in the second quarter, however, the BoC did note in their most recent Policy Rate Announcement that they expected a contraction between 15 and 30%, roughly in line with the data coming out of the U.S.

Elected officials have also been having troubles reaching an agreement about how to support unemployed citizens whose jobs disappeared because of the novel coronavirus. Enhanced unemployment benefits and a moratorium on evictions both expired at the end of last week in the U.S., and officials in Canada face resistance from MPs who suggest that extending emergency funds provides a disincentive to work.

Earnings, however, offered a glimmer of positive news for investors. Al Root of Barron’s reported, “…companies are crushing overly bearish estimates…More than 300 companies have reported second-quarter numbers so far. About 85 percent are beating Wall Street earnings estimates by an average of 22 percent.”

Overall, blended earnings for the S&P 500 index has declined 35.7 percent. If that is the actual change in earnings for the second quarter, it would be the biggest year-over-year decline since the fourth quarter of 2008 when earnings dropped 69.1 percent.

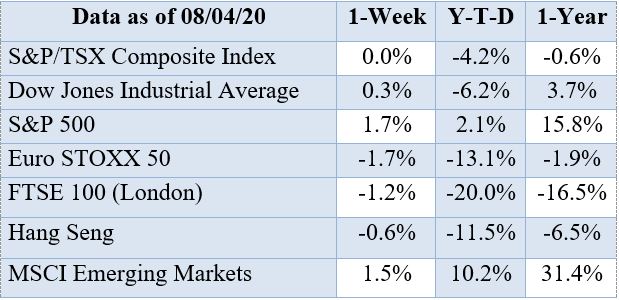

The S&P 500 and the Nasdaq Composite both gained last week, The Dow Jones Industrial Index finished the week lower, and the S&P/TSX Composite index finished more or less flat. If you have any questions or concerns about your portfolio or current market conditions, please don’t hesitate to give us a call.

Source: Refinitiv

FAST FOOD FOR THOUGHT. In 1986, The Economist developed a tasty way to assess whether currencies are trading as they should be: The Big Mac Index.

In theory, countries’ exchange rates should allow a person to buy the same product – in this case, a burger – for the same amount of money in any currency. In reality, currencies are often undervalued or overvalued. When an analyst says a country’s currency is undervalued relative to the U.S. dollar, it means a burger costs less in that country than it does in the United States.

For example, in June 2020, a fancy burger cost about $5.71 in the United States. In Britain, it cost £3.39, which is about $4.46 using last week’s exchange rate. That makes a British burger a lot less expensive than a U.S. burger. If the currencies were aligned properly, the burger should have cost £4.34. So, in this example, the British pound is undervalued relative to the U.S. dollar.

In June, visitors to Switzerland paid more for burgers than they would have in the United States. A Swiss burger cost SFr6.50 or about $7.15 in June 2020. If the currencies were aligned, the burger would have cost about SFr5.19.

The cheapest burger in the world was found in South Africa, where it sold for 31.00 rand or $1.83 in June. If the currencies had been in parity, then a South African burger would have cost 96.97 rand. You also can buy a burger for less in China. The Economist explained, “A [burger] costs 21.70 yuan in China and $5.71 in the United States…[This] suggests the Chinese yuan is 45.7 percent undervalued.”

The Big Mac Index should be taken with a grain of salt. It’s an imprecise tool some economists find hard to swallow because the price of a burger should be lower in countries with lower labor costs, and higher in countries with higher labor costs. When index prices are adjusted for labor, the Thai baht and Brazilian real are the world’s most overvalued currencies relative to the U.S. dollar, while the Hong Kong dollar and the Russian ruble are the most undervalued.

Weekly Focus – Think About It

“There are basically two types of people. People who accomplish things, and people who claim to have accomplished things. The first group is less crowded.”

--Mark Twain, Author and Humorist

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager