Weekly Market Commentary - March 10th, 2021

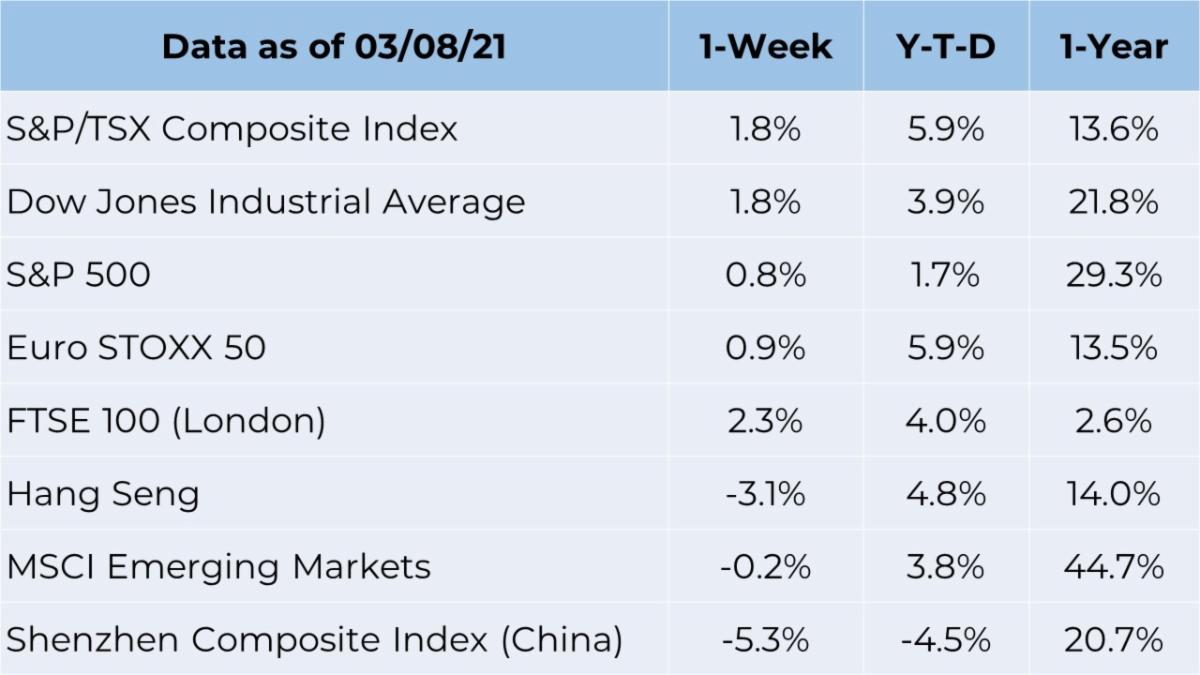

The Markets

Neanderthal DNA may make people more – or less – susceptible to the coronavirus, reported The Economist. It all depends on whether you have the genes and, if you do, which DNA string you inherited.

No matter what your gene sequence looks like, vaccines can help fight the virus. So far, all of the vaccines available in the United States have proven to be effective in preventing hospitalization and death from coronavirus, according to the American Centers for Disease Control (CDC).

South of the border, we saw the economic effect of accelerating vaccinations last week when the number of new jobs created in February exceeded expectations. The Bureau of Labor Statistics reported there were 379,000 new jobs, primarily in the leisure and hospitality sector, which was hard hit by the virus and lockdowns. By comparison, Canada’s vaccination program is lagging, and our unemployment rate remains higher.

The Economist reported, “…there is a strong case for optimism. The experience of places such as New Zealand and Australia is that once the threat of coronavirus has passed, people are keener than ever on being out and about. Meanwhile, the vaccine roll-out continues to accelerate…The Senate is considering another $1.9trn in stimulus, including [cheques] of $1,400 to most Americans. The job market has been deeply wounded. But there are growing reasons to hope that it might heal rapidly.”

Positive U.S. labor market news inspired a rally on Friday; however, earlier in the week, concerns about rising Treasury rates pushed North American stock markets lower. The yield on Canadian 10-year Treasury notes rose as high as 1.6 percent on Friday, following the jobs report, before retreating to 1.5 percent, reported Yun Li of CNBC. The yield Canadian 10-year government bond rates have similarly been trending upwards.

If you have any questions or concerns about your investment portfolio or current market events, please don’t hesitate to give us a call.

Source: Refinitiv

Announcements and Reminders

At the Muir Investment Team we care about you and not only your material wealth, we know that your health is just as important. In light of that, we wanted to invite you to a webinar being hosted by our parent company titled Rest, Refocus and Recharge. Read below for more information and to sign up.

Rest, Refocus, Recharge

After a year of living through an unprecedented pandemic, it goes without saying that we could all benefit from the opportunity to rest, refocus and recharge. This is what our next Client Insights Seminar is all about. Featuring Dr. Greg Wells, one of Canada’s leading health and performance experts, this seminar will explore valuable and easy ways to enhance your physical and mental well-being.

Central banks are introducing digital currencies

In January, The Bureau of International Settlements (BIS) surveyed central banks and found most (86 percent) were considering central bank digital currencies (CBDC):

“CBDC is different from cash, as it comes in a digital form unlike physical coins and banknotes. CBDC is also different from existing forms of cashless payment instruments for consumers such as credit transfers, direct debits, card payments and e-money, as it represents a direct claim on a central bank, rather than a liability of a private financial institution. This type of riskless claim also makes CBDC different from cryptocurrencies…or other private digital tokens…”

The BIS defined cryptocurrencies as “decentralized digital tokens without an issuer that are not representative of any underlying asset or liability,” stating private digital tokens “…have an identifiable issuer or represent a claim and/or underlying assets.”

There are many potential benefits of CBDC. The Economist reported:

“Cashless transactions make for faster, more reliable payments and are less susceptible to counterfeiting. Issuing digital cash is cheaper than minting coins, so long as it is protected against hacking. Officials also have an easier time monitoring how digital money is used, making it harder to fund criminal activities. In poorer countries, central banks hope that digital currencies will bring unbanked citizens into the financial system, boosting economic development.”

Central banks in developed countries have been slower to pursue CBDC than those in emerging nations. According to BIS, seven of the eight banks engaged in advanced CBDC planning are in emerging countries. China’s central bank is leading the CBDC charge among developed nations. It recently introduced the electronic Chinese yuan, or eCNY.

When evaluating CBDCs, it’s important to understand how the currency operates. For example, Felix Salmon of Axios reported on China’s eCNY:

“…doesn't use blockchain technology. Instead, the ledger of who owns what is closely held at the Chinese central bank – and nowhere else…eCNY requires full trust of the Chinese monetary authorities. If it goes global, then China will at all times know exactly how much of its currency you possess – and could zero you out for any or no reason.”

CBDCs may become part of the new normal that emerges as the coronavirus threat passes.

Weekly Focus – Think About It

“If this country is ever demoralized, it will come from trying to live without work.”

--Abraham Lincoln, 16th U.S. President

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager