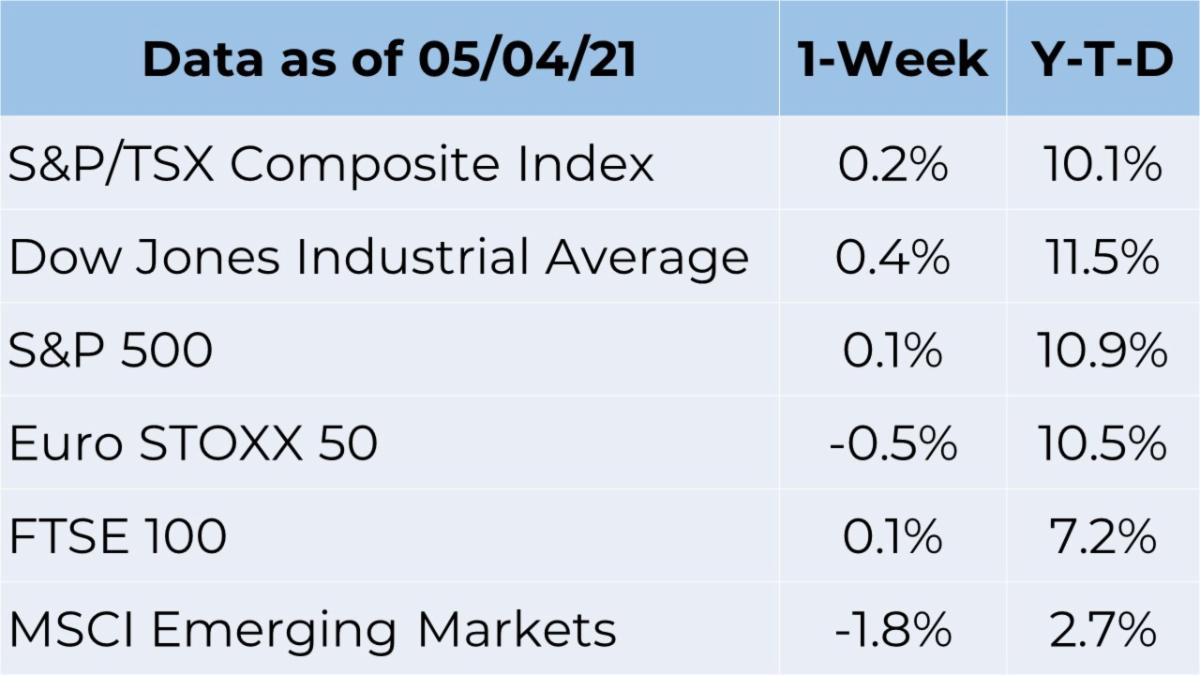

Weekly Market Commentary - May 21st, 2021

The Markets

Ever since the financial crisis, central banks have pursued expansionary monetary policies to encourage reflation and avoid deflation. Well, it’s taken some time, but inflation is finally here.

Last week, major North American stock indices moved lower after inflation, as measured by the increase in cost of items in the (American) consumer price index (CPI), was four times greater than anticipated.

Higher inflation is the result of many factors, including the current supply and demand imbalance. As the pandemic has calmed in much of the world, consumers have emerged eager to spend money – so eager that consumer spending is about 5.5 standard deviations above average. That’s a lot.

The problem is finding stuff to buy. The Economist explained, “…red-hot demand is increasingly met slowly or not at all…Nowhere are shortages more acute than in the United States, where a boom is under way. Consumer spending is growing by over 10 percent at an annual rate, as people put to work the $2trn-plus of extra savings accumulated in the past year.”

These shortages are the result of two kinks in the supply hose.

The first is the supply chain. There is a shortage “of everything from timber to semiconductors,” which are essential to building other products. In addition, shipping containers have become a scarce resource, causing the cost of shipping goods from China to the United States to triple, reported The Economist.

The second is labour. This week’s higher-than-expected inflation data mirrored last week’s lower-than-expected employment data out of the U.S. (Canadian statistics are often published months after their American counterparts, but data out of the U.S. does allow us to make educated guesses about the state of the Canadian economy).

No one is certain why the employment numbers were lackluster, although theories abound. Regardless, there are limits on what companies can produce when they have too few employees.

The question we face now is whether supply chains can be straightened so demand for goods and services can be met. If so, higher inflation may prove transitory as the U.S. Federal Reserve and some economists anticipate. If not, inflation may stick around. Time will tell.

If you have any questions or concerns about current market conditions or your investment portfolio, please don’t hesitate to give us a call.

Source: Refinitiv

Upcoming Events:

Gardening Webinar - June 8th at 7:00 PM

Click Here To Sign Up - June 8th at 7:00 PM

Confidence is returning

The big news last week from south of the border was the announcement from the U.S. Centers for Disease Control (CDC) that fully vaccinated Americans can resume normal activities without wearing masks or social distancing, except where required by law. Hopefully, as Canada’s vaccination program progresses, we too will be able to return to normalcy.

Results from the latest Axios-Ipsos Coronavirus survey, conducted in early May, found people were feeling more optimistic. Among those surveyed:

- 59 percent had visited friends or relatives during the previous week.

- 54 percent had gone out to eat during the previous week.

- 31 percent had made plans for the summer.

- 18 percent had a stronger sense of emotional well-being, a six-point jump from the prior survey.

- 60 percent indicated trips to salons, barber shops, and spas were low- or no-risk activities, up six points from the last survey.

If your exuberance about resuming “normal” life has been tempered by a reluctance to change the routines you’ve adopted during the pandemic, you’re not alone. Medical experts at Northwestern University explained:“The emotional impact of this past year may linger with us for longer than we might expect. The key is not to feel forced to snap back into a routine overnight. Give yourself time and understand that your emotional journey back to freely socializing in vaccinated cohorts may look very different from those around you.”

As some people say, “You do you.”

Weekly Focus - Think About It

“We must have ideals and try to live up to them, even if we never quite succeed. Life would be a sorry business without them. With them it's grand and great.”

--Lucy Maude Montgomery, Author

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager