Weekly Market Commentary - July 7th, 2021

The Markets

The Economist developed the Global Normalcy Index (GNI) to measure the post-pandemic return to normal. In March 2020, the GNI was 35 overall, with 100 being the normal pre-pandemic level. At the end of the second quarter, the worldwide GNI was 66, or about two-thirds of the way back to normal.

Employment is improving slowly in the U.S., but Canada lags behind. Last week’s jobs report showed a better-than-expected gain of 850,000 jobs in June in the United States. However, April and May jobs reports were below economists’ expectations. In June, the unemployment rate was 5.9 percent, which is an improvement on the double-digit pandemic unemployment rate, but above the pre-pandemic level of 3.5 percent. As of the most recent data from Statistics Canada, which generally lags behind the American data by a month, our unemployment rate rose to 8.2 percent.

This discrepancy may be as a result of the fact that the U.S. reopened earlier than Canada, and while many Canadian provinces had strict lockdowns, parts of the U.S. that used a more laissez-faire approach saw lower than average Coronavirus deaths and did not experience the same level of economic decline.

For example, in Florida, which had locked down briefly at the beginning of the pandemic before almost completely opening up after only a few months, there were fewer per-capita coronavirus deaths in general, as well as fewer deaths among the elderly than in some states that had strict lockdown measures, such as California and New York, even though Florida boasts a population that is, on average, older.

Employers are having trouble filling positions. Despite the fact that 9.3 million people remain out of work, trucking companies, airlines, restaurants, hotels, shipyards, factories, banks and other employers report having difficulty filling open positions.

Suzanne Clark, the CEO of the U.S. Chamber of Commerce, stated that solving the worker shortage should be the nation’s top priority. She suggested expanding access to childcare, supporting employer-led skills training, ending supplemental unemployment benefits, welcoming global talent and prioritizing second-chance hiring.

Workers are leaving jobs. Hidden among the employment data coming out of the U.S. was a surprising trend that some have dubbed ‘The Great Resignation.’ In June, 942,000 Americans – 9.9 percent of those who were unemployed – were job leavers. They had resigned from their jobs. For comparison, the number of people leaving jobs during the entire second quarter of 2019 was 809,000.

Prices are rising more quickly than anticipated. Anyone who shopped for groceries for a Canada Day barbecue or made an above-asking-price offer for a house knows that prices have moved higher.

Core Personal Consumption Expenditures (PCE without food or energy), which is the U.S. Federal Reserve’s favored measure for inflation, rose steadily during the second quarter. In May, core PCE was up 3.4 percent. When food and energy were included, PCE was up 3.9 percent. This is comparable to here in Canada, where we use the Consumer Price Index (CPI) to measure inflation. In May, the CPI increased to 3.6 percent, up from 3.4 percent in April.

Inflation concerns consumers. Consumer sentiment was up year-over-year from May 2020 to May 2021. However, inflation dampened sentiment and expectations declined from April 2021 to May 2021, according to the University of Michigan’s Surveys of [American] Consumers.

“Twice as many [American] consumers expected that the inflation rate would be 5% or more in the year-ahead rather than 2% or below (44% versus 22%). Importantly, consumers still anticipated declining inflation over the longer term,” reported Director of Surveys Richard Curtin.

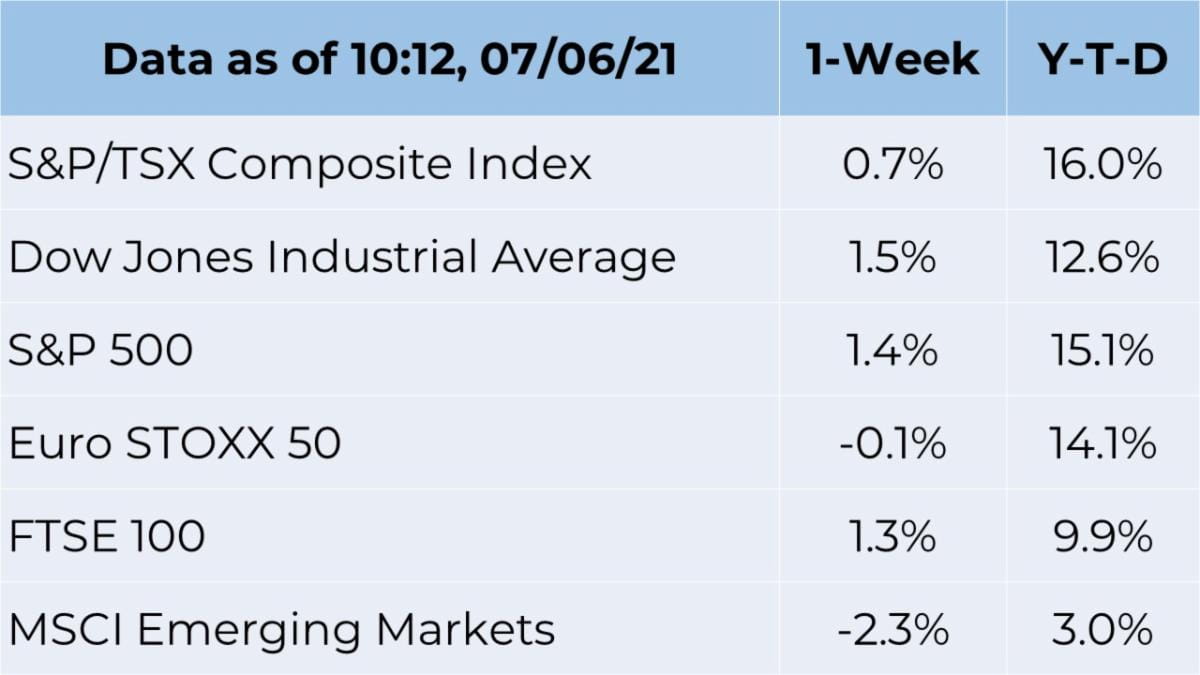

North American equity markets continued to move higher during the second quarter. The S&P 500 index gained 8.2 percent during the second quarter of 2021, compared with the S&P/TSX Composite index, which increased by a lesser yet still respectable amount, gaining 6.2 percent over the same period of time.

Source: Refinitiv

The housing market boom

Low mortgage rates, high demand for homes and a limited supply of existing homes have pushed the cost of North American housing through the roof. In May, home prices south of the border were 23.6 percent higher than they were a year ago. Here in Canada, we haven’t seen quite as dramatic an increase, though our house prices have seen on average a 13.8 percent increase in the same period.

It isn’t just North America -- housing prices are higher around the globe. Sweden, Denmark, Russia, South Korea, Taiwan, the United Kingdom, and other nations have seen home prices increase, too, reported Delphine Strauss and Colby Smith of the Financial Times.

While high demand and rising prices are good for homeowners, the phenomenon has economists and policymakers worried. The runaway market holds two concerns: Prices could spiral into bubble territory, making economies vulnerable to a sudden market correction that would hit household wealth, and home ownership could become even more unaffordable for young people and key workers who were already priced out of many areas before the pandemic.

Weekly Focus - Think About It

“Freedom is never more than one generation away from extinction. We didn't pass it to our children in the bloodstream. It must be fought for, protected, and handed on for them to do the same.”

― Ronald Reagan, 40th President of the United States of America

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager