Weekly Market Commentary - August 25th, 2021

The Markets

Markets were shaken last week by a potent cocktail of central bank tapering and economic growth concerns mixed with coronavirus and a splash of the new Chinese privacy law.

On Wednesday, the minutes of the United States Federal Reserve’s Open Market Committee Meeting were released. They confirmed the Fed could begin tapering – buying fewer Treasury and U.S. government agency bonds – sooner rather than later, reported Jack Denton and Jacob Sonenshine of Barron’s. While that wasn’t new information, investors startled like cats surprised by cucumbers, triggering a broad sell-off.

In the United States, economic data was mixed. The U.S. Census reported that retail sales declined in July, suggesting weakening consumer demand. Normally, that’s not great news because consumer demand drives U.S. economic growth. However, with inflation at the highest level in more than a decade, lower demand could help relieve upward price pressure.

“Lower consumer demand was accompanied by improving supply.” Lisa Beilfuss of Barron’s reported, business inventories rose in June at the fastest clip since October as wholesalers and manufacturers posted solid increases and retailers saw inventories rise for the first time in three months. From a year earlier, inventories across American businesses rose 6.6%, compared with a 4.6% pace a month earlier.”

Of course, we could see supply bottlenecks again if a COVID-19 surge results in new lockdowns and continued worker shortages.

Finally, on Friday, Chinese stocks dropped sharply after Beijing announced that a new strict data-privacy law will take effect on November 1, 2021. Investors remain concerned that China’s regulatory tightening will affect other market sectors, including fintech, gaming and education, reported Hudson Lockett of the Financial Times.

“American investors’ shock at an ongoing regulatory crackdown in China points to a fundamental difference between the two countries,” reported Evelyn Cheng of CNBC. “…whereas the U.S. system is designed to let corporations influence the government, China’s system is designed to bring corporations in line with government goals.”

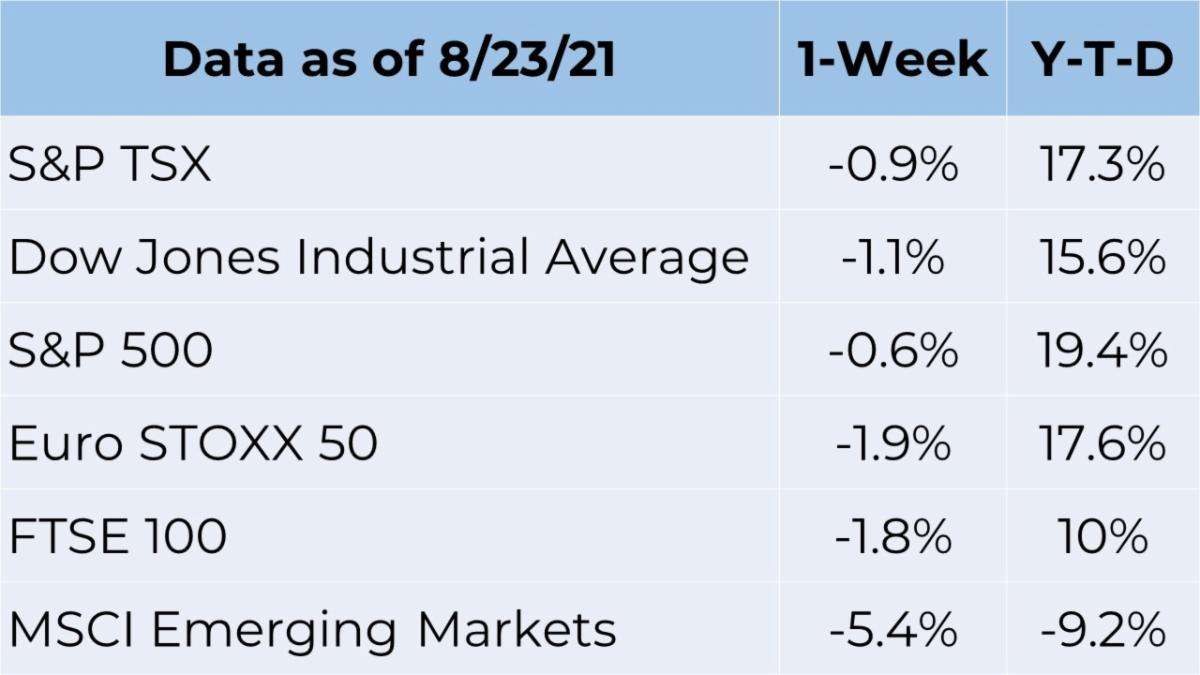

Major U.S. stock indices finished the week lower. The yield on 10-year U.S. Treasuries finished the week where it started.

Source: Refinitiv

Click here to read our Blog.

Click here to find Upcoming Events.

Click below to find us in Social Media

What's making the U.S. more productive?

It seems as though everyone is talking about digital currencies these days. Among the topics being discussed are:

1. Should the Federal Reserve issue a central bank digital currency (CBDC)?

2. Should digital currencies be better regulated?

In July, Federal Reserve Chair Jerome Powell confirmed that he is undecided about whether the Federal Reserve should issue a CBDC, reported Ann Saphir and Dan Burns of Reuters. He indicated that digital currencies have failed to become a widely accepted means of payment, although a CBDC would eliminate the need for private digital money, especially digital currencies that claim to be pegged to the U.S. dollar. Chris Matthews of MarketWatch explained:

“Critics of stablecoins say they pose significant risks to financial stability, especially after it was revealed that some of these dollar-pegged tokens are not backed by actual U.S. dollars, but a combination of riskier assets…[Chair] Powell said in a congressional hearing that regulators need to apply rules to stablecoins that are similar to those that govern bank deposits and money market mutual funds.”

Congress and the Securities and Exchange Commission (SEC) are both considering ways to regulate digital currency. The pending bipartisan infrastructure bill includes tax-reporting requirements for cryptocurrency brokers. If the bill passes without changes, digital currency sales would be reported to the IRS in much the same way that stock sales are. The change is expected to generate about $28 billion in taxes over a decade to help pay for infrastructure, reported Marcy Gordon of AP News.

In addition to tax regulation, digital currencies may become subject to greater securities regulation. In early August, SEC Chair Gary Gensler discussed the need for cryptocurrency regulation at the Aspen Securities Forum. He said:

“As new technologies come along, we need to be sure we’re achieving our core public policy goals. In finance, that’s about protecting investors and consumers, guarding against illicit activity, and ensuring financial stability… at our core, we’re about investor protection. If you want to invest in a digital, scarce, speculative store of value, that’s fine. Good-faith actors have been speculating on the value of gold and silver for thousands of years…I believe we have a crypto market now where many tokens may be unregistered securities, without required disclosures or market oversight. This leaves prices open to manipulation. This leaves investors vulnerable.”

It seems that changes are coming for the cryptocurrency market.

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager