Weekly Market Commentary - November 17th, 2021

The Markets

Economists like to joke that inflation is just right when no one notices it.

Last week, investors noticed it. The U.S. consumer price index (CPI), which is a measure of inflation, rose 0.9 percent in October and 6.2 percent over the last 12 months, according to the Bureau of Labor Statistics (Canadian CPI numbers are not yet out for October, but our CPI has also been trending upwards, hitting 4.4 percent over the last year by the end of September).

That’s the highest level for inflation in the U.S. in the last 30 years, according to The Economist, and well above the United States Federal Reserve’s (“The Fed’s”) policy goal of two percent inflation over the longer term.

Uncertainty about the nature of inflation has left the U.S. Federal Reserve wedged in an uncomfortable policy position. The Economist explained:

“As inflation has accelerated economists and officials have debated whether it is a transitory phenomenon—reflecting overstretched supply chains [caused by Biden administration policies] — or a more persistent problem. It is far more than an academic debate. If inflation is short-lived, the right move for the Federal Reserve would be to look through it, aware that jacking up interest rates may do more harm than good. If, however, inflation is stubbornly high, the central bank is duty-bound to tame it,”

Taming inflation could mean tapering bond buying and raising rates more quickly than planned, and higher rates tends to slow and, sometimes, stall economic growth.

When making policy decisions, while the Government of Canada relies on our own CPI, personal consumption expenditures (PCE) is the Fed’s preferred inflation gauge. The readings for the CPI and the PCE rely on information from different sources; the CPI measures inflation in items that households commonly pay for, while the PCE covers a wider range of expenditures, including items such as medical insurance.

Importantly as well, the PCE shows less variation in inflation because, as Fanglue Zhou of Callan Associates explains,

“The expenditure weights in the PCE can change as people substitute away from some goods and services toward others. Thus, if the price of bread goes up, people buy less bread, and the PCE uses a new basket of goods that accounts for people buying less bread. The CPI, however, is less fluid in response to changing consumer preferences.”

What this means is that the PCE has the ability to report much lower inflation numbers – numbers that look better to policy makers, but may not be realistic for families living in the real world. For instance, if in the example above, a consumer buys bread weekly, and bread prices increase by 10 percent, they could find a substitute and their expenses would increase in line with the PCE, but at the end of the day, the cost of bread has still increased by 10 percent, and removing it from the basket of goods does not change the fact that a consumer who continues to buy bread will see their expenses increase by more than the PCE would suggest.

This also means that, because the basket of goods contained in the PCE changes, both in weightings and in content (note that the basket of goods contained in the CPI changes as well, but not as frequently), comparisons between different time periods are not useful if any changes have been made, as they are not apples-to-apples comparisons.

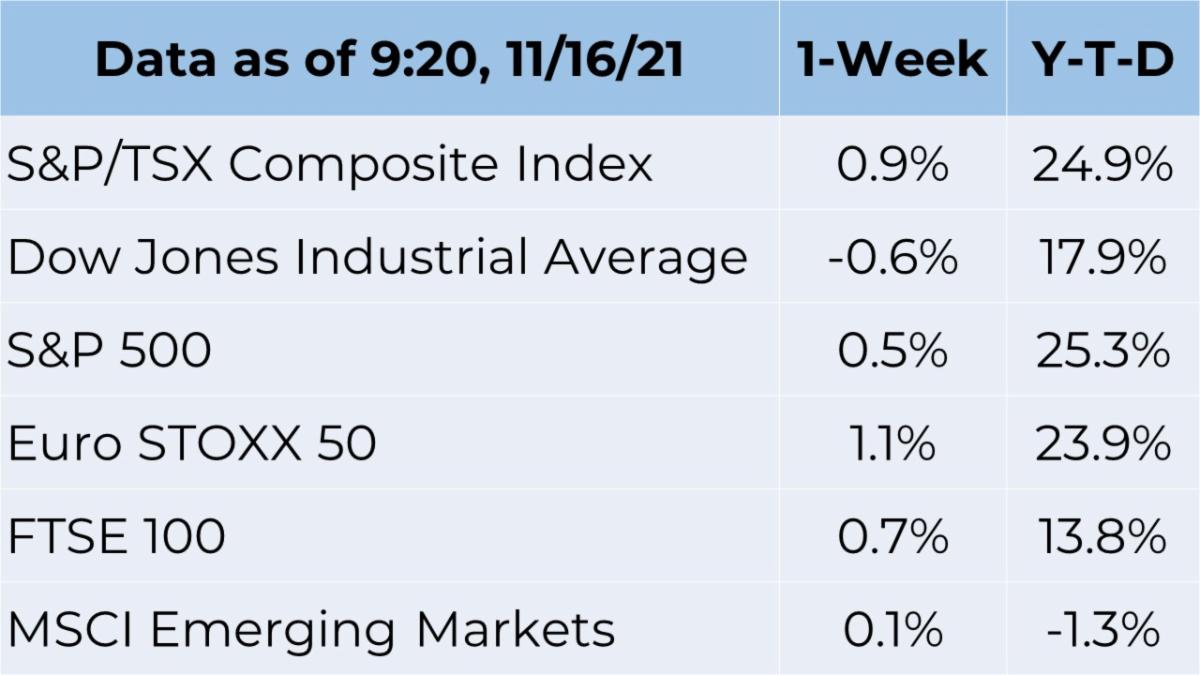

Major U.S. stock indices retreated a bit last week, while the S&P/TSX Composite index ended on a high note. In the fixed income markets, the yield on 10-year U.S. Treasuries and Government of Canada bonds rose last week.

Source: FactSet

Upcoming Webinar:

What can James Bond teach us about travel medicine?

Recently, Travel Medicine and Infectious Disease, a research journal, published “No time to die: An in-depth analysis of James Bond's exposure to infectious agents.”

The authors focused their research on 007 because they felt an occupational kinship to the fictional British secret agent. “Life as infectious disease researcher is indisputably exciting. Daily encounters with life-threatening microorganisms, academic competitors, hostile reviewing committees, and extensive international travel can make for a thrilling career. International espionage is possibly the only profession that overshadows our branch of academia in these respects.”

The team spent almost 52 evening hours evaluating whether Bond, James Bond, adhered to international travel advice during the 86 trips he took to other countries, on film, between 1962 and 2021. The authors concluded the MI6 agent, “…is an exemplar of reckless disregard for occupational health but serves as a useful tool for drawing attention to the important issue of infectious disease risk while working and traveling.”

Among the many issues identified, the paper’s authors reported that James Bond was:

Woefully uneducated about the dangers of food-borne infections and the precautions necessary to prevent them. In particular, he is only seen to wash his hands twice. Viewers can only hope the soap-and-water action was occurring offscreen.

Cavalier about protecting against insect bites on trips to the Bahamas, Jamaica and India which put him at risk for malaria, dengue and chikungunya, respectively. Bond failed to apply insecticide and slept with his windows open. The researchers suggested that Bond’s watch be equipped with insect-fighting technology.

At high risk of dehydration. “Alcoholic beverages, shaken or stirred, do not prevent dehydration, which is a major concern given the extremes of physical activity he goes to, often in warm climates. On only three occasions was Bond observed drinking non-alcoholic drinks: orange juice, coffee and salt water, of which the latter is particularly unhelpful in maintaining fluid balance.”

In the end, the authors encouraged MI6 to better prepare its fictional agents for missions to foreign destinations. After all, they only live once.

Weekly Focus - Think About It

“To be yourself in a world that is constantly trying to make you something else is the greatest accomplishment.”

—Ralph Waldo Emerson, philosopher

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager