Weekly Market Commentary - April 14th, 2022

The Markets

The first quarter of 2022 was jam-packed with volatility-inducing events: rising inflation, war in Ukraine, rising interest rates, and sanctions on Russia.

Here’s a brief review of what happened during:

Inflation continued to rise. At the start of the year, consumers and investors were primarily concerned about inflation. In February, the (U.S.) Personal Consumption Expenditures Price Index showed core inflation, which excludes volatile food and energy prices, was up 5.4 percent year-over-year. That’s well above the Federal Reserve (Fed)’s two percent target for inflation, and still slightly below Canada’s Consumer Price Index (CPI), which recorded a price increase of 5.7 percent.

Investors expect central banks to continue fighting inflation in 2022 by raising their target rates. Raising rates makes borrowing more expensive, which causes consumer and business spending to slow, demand for goods and services to drop, and prices to move lower, reported Carmen Reinicke of CNBC.

Russia invaded Ukraine and sanctions followed. In late February, Russia escalated the almost decade-long conflict in Eastern Ukraine by invading. The war has devastated the people and the economy of Ukraine. The Kyiv School of Economics estimated that physical damage inflicted on Ukraine’s roads, bridges, rails, ports, residences, factories, airports, hospitals, and schools from February 24 to April 1 exceeded $68 billion, reported The Economist. As the human and economic costs of the war filtered through markets:

- Energy prices surged around the world: Being that Russia is one of the largest producers of crude oil, prices finished the quarter 33 percent higher – after declining 20 percent from their highest price during the quarter. One result was that energy and utility sectors delivered strong returns relative to other market sectors during the quarter, reported Lauren Solberg of Morningstar.

- Higher energy prices also exacerbated global inflation. For example, rising fuel prices lifted other prices, too. The cost of diesel fuel, which is primarily used for trucking and shipping, rose 63 percent in the United States during the first quarter. Higher transportation and delivery costs were reflected in the cost of other goods, including food, reported Brian Swint of Barron’s.

- Global food prices increased: Ukraine and Russia were key exporters of grains and cooking oils, as well as other products. Since February, when the war began, the price of wheat has increased by almost 20 percent, corn by 19 percent, barley by 27 percent, and vegetable oils by 23 percent, according to The Economist.

Central banks continued to tighten monetary policy. The escalation of hostilities in Ukraine complicated the outlook for economic growth and inflation around the world. Despite uncertainty about growth, many central banks tightened monetary policy to bring inflation down.

In North America, both the Fed and the Bank of Canada raised rates by 0.25 percent in March. Fed officials expect to raise rates six more times in 2022 and begin reducing the Fed’s balance sheet, a process known as quantitative tightening, at its May meeting.

Yields on U.S. Treasury notes and Government of Canada bonds shifted higher during the quarter and into April. The yield on the 2-year Treasury note rose from 0.78 percent at the start of the year to 2.53 percent at the end of last week, while the benchmark 10-year Treasury yield rose from 1.63 percent to 2.72 percent. By comparison, bonds north of the border have made similar moves, with the Government of Canada 2-year bond rising from 0.95 percent to 2.43 percent, and the 10-year bond going from 1.42 percent to 2.47 percent.

When bond yields rise, bond prices fall. In the first quarter, Morningstar indices for Treasuries, corporate, high-yield, and mortgage bonds all moved lower.

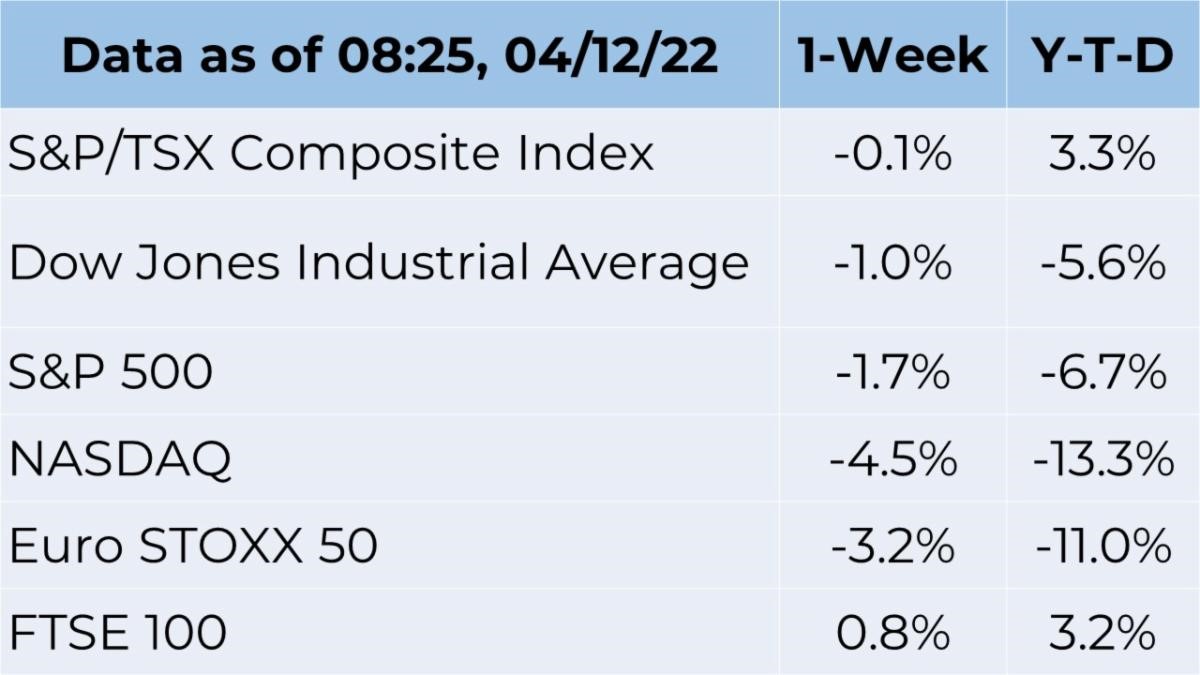

Overall, American stock markets declined during the first quarter of 2022, while the S&P/TSX Composite index managed to remain above water. The MSCI All Country World Index (ACWI) measures the performance of mid-sized and large company stocks in 23 developed markets and 24 emerging markets. It reflects the performance of about 85 percent of the investable stocks across the world and finished the first quarter of 2022 -5.36 percent.

The were some regions that delivered positive returns during the period. For example, markets in some commodity-exporting countries in Latin America, Africa, and the Middle East benefitted from the supply disruptions that followed Russia’s invasion of Ukraine.

We anticipate that markets will remain volatile in the coming weeks and, possibly, months. We will continue to monitor events around the world and the ways in which they may affect markets and asset prices and we hope peace talks will conclude the war in Ukraine.

Source: FactSet

Survery corner:

We are planning on hosting a cycling event this summer after great feedback. Let us know if you're interested.

Cycling Event (May/June 2022)

Let us know your interests, that way we can plan events and campaigns around that. Fill out the survey below.

Special Events

Ride for Heart fundraiser

Thank you for all your support we've already raised 20% of our goal!

A cure for brain freeze

Brain freeze is the sharp, painful headache that occurs after you’ve eaten cold foods or drinks too quickly. When something extremely cold touches the roof of the mouth, the capillaries in the sinuses cool and blood vessels narrow. While many people press a palm to their foreheads when they experience brain freeze, that’s not a particularly effective cure. Better options may be to:

- Drink warm water,

- Press your tongue to the roof of your mouth to warm the area, or

- Cover your mouth and nose with your hands and breathe so warm air flows over your palate.

Here’s something else to keep in mind: eating hot foods on hot days may cool the body effectively, so long as the foods make you sweat. Sweating helps lower body temperature.

Weekly Focus - Think About It

“The supreme quality for leadership is unquestionably integrity. Without it, no real success is possible, no matter whether it is on a section gang, a football field, in an army, or in an office.”

—Dwight D. Eisenhower, 34th President of the United States

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Financial Advisor