Weekly Market Commentary August 4th, 2022

The Markets

Last week, we learned from the Bureau of Economic Analysis (BEA) that economic growth in the United States slowed for the second consecutive quarter (a reminder that Canadian data will not be released until the end of August). Economic growth is measured by gross domestic product, or GDP, which is the value of all goods and services produced in a country during a specific period. GDP includes household, business and government spending, as well as exports and imports.

Before inflation, the U.S. economy grew by 6.6 percent in the first quarter of 2022 and by 7.9 percent in the second quarter, according to the FRED Economic Data. While these numbers sound very positive, the economy did not outpace inflation. In real terms, U.S. GDP shrank by 1.6 percent in the first quarter and by 0.9 percent in the second quarter.

Is it a recession or isn't it?

Two consecutive quarters of negative growth has been an accepted popular definition of recession for decades, to the point that it is used as the definition of recession in many macroeconomics textbooks.

There was a lot of debate last week about whether the U.S. is in a recession. Official numbers showed that real GDP declined in the last two quarters, and both the 2 to 10 year and 6 month to 10 year yield curves have inverted, but there are also some positive indicators worth mentioning.

Much of this debate was caused by U.S. government officials, who, in the lead-up to the midterm elections, have attempted to confuse the issue by asserting that two consecutive negative quarters was never a widely accepted definition for recession. They assert that, even though the economy has contracted for two consecutive quarters, the U.S. is not in a recession because unemployment is low and consumer spending, while declining, is still strong, even though one can easily look up past press conferences, such as one given by former President Bill Clinton on December 19, 2000 where he states unequivocally that a “recession is two quarters in a row of negative growth”.

Whether or not you believe that the U.S. is in a recession, it is certainly not in the current administration’s favour to admit that a recession has occurred on their watch with elections on the horizon, especially with recent polling, such as one poll out of Monmouth University in July, which suggested that 42 percent of Americans are struggling financially, and the top issue for 63 percent of voters is either inflation, gas prices, the economy, or everyday bills, as reported by NBC News.

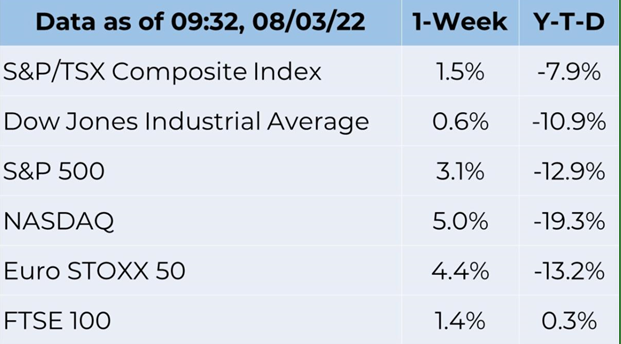

Financial markets rallied

In unscripted remarks, Fed Chair Jerome Powell indicated that interest rates had reached a neutral level. When rates are neutral, monetary policy is neither contractionary nor expansionary. Investors took Powell’s comment to mean the Fed might ease rates sooner rather than later, and markets rallied, wrote Economist Mohamed A. El-Erian in a Bloomberg opinion piece.

While the rally was welcomed by investors, looser financial conditions are the opposite of what the Fed wants to achieve. It appears the Fed has more work to do.

If you have any questions or concerns about your investment portfolio or recent market conditions, please don’t hesitate to give us a call.

Recent Market Update Videos:

|

WATCH ON OUR WEBSITE, CLICK HERE |

Company sales and profits were up in the second quarter

A perceived dovish tilt at the Fed wasn’t the only reason stocks rallied last week. It’s earnings season – that wonderful time when leaders of publicly traded companies tell investors how they performed during the last quarter and share expectations for the future. Investors review the information and use it to make decisions about whether to buy, sell or hold shares.

More than half of companies in the S&P 500 index had reported by the end of last week. Earnings (profits) were better than expected for about three out of four of those companies. So far, companies in the energy and industrials sectors are the standouts for the second quarter. Energy sector earnings were up 290.3 percent (mainly due to skyrocketing oil prices) and industrial sector earnings were up 25.7 percent, reported John Butters of FactSet. The consumer discretionary (down 17.9 percent) and financials (down 25.0 percent) sectors are the weakest performers, to date.

Revenue, which is the value of goods and services sold, was up more than 12 percent among the companies that have reported so far. Every sector of the index reported higher revenue for the second quarter with energy (up 66.4 percent), materials (up 16.1 percent), and real estate (up 14.7 percent) leading the way. The communication services (up 5.8 percent) and financials (up 2.5 percent) sectors lagged.

“Despite worrisome signals from economic proxies like [a big box retailer] and [a shipping and supply chain management company], the earnings season as a whole has turned out to be brighter than expected...That’s fueling speculation that Corporate America will be able to weather the perfect storm of hot inflation, jumbo-sized rate hikes and dwindling growth,” reported Rita Nazareth of Bloomberg.

While a significant number of companies have yet to report, blended second quarter earnings for companies in the S&P 500 index were up 6 percent.

Weekly Focus – Think About It

“Let your dreams outgrow the shoes of your expectations.”

—Ryūnosuke Satoro, author and poet

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Financial Advisor

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.