Weekly Market Commentary - October 6th, 2022

The Markets

So far, 2022 has been a tough year for investing. We’ve experienced an unusual phenomenon – the simultaneous decline of stock and bond markets. Throughout the third quarter, investors’ concerns focused on global instability, rising prices and the possibility that central bank efforts to tame inflation would cause economic growth to falter. The result has been tremendous volatility in stock and bond markets.

Early in the third quarter, after experiencing a large downward swing, North American stock markets gained ground as investors latched onto the idea that inflation had peaked, and the central banks would soon moderate the pace of rate hikes. Following the release of July’s Consumer Price Index (CPI) from south of the border, Carleton English of Barron’s reported:

“Wall Street got a dose of good news this week. It also got a little ahead of itself. Inflation slowed in July, according to Department of Labor data released on Wednesday…It makes sense that investors would celebrate the easing of prices. But it may be too early to pop the Champagne – inflation standing at 8.5 percent is still a long way from the Federal Reserve’s target of two percent, and the Fed is likely to continue tightening until it is under control.” North of the border, the Canadian CPI reported a seven percent increase in prices in the same period.

North American stock markets trended higher through mid-August when Fed Chair Jerome Powell made it clear the Fed did not share investors’ optimistic inflation outlook. It still viewed inflation as a threat and planned to continue to raise rates aggressively into 2023. The Bank of Canada has also raised rates multiple times this year and will likely to continue to move in the same direction as the Federal Reserve.

Other central banks also concurred. Last week, Katie Martin of Financial Times reported, “In an extraordinary sweep, central banks from the U.S. to Switzerland embarked on what looked like competitive policy tightening… central banks delivered a massive combined total of six percentage points of rate rises just this week.”

Aggressive central bank tightening caused investors to reassess their expectations. The result was a market sell off. “In the month since Federal Reserve Chair Jerome Powell laid down a hard line on inflation, stocks have suffered double-digit losses, chasms have opened in global currency markets, and yields on the safest U.S. government debt have surged to their highest levels since the dark days of the financial crisis nearly a decade and a half ago,” reported Howard Schneider of Reuters.

There is a concept in financial markets known as capitulation. It occurs when fear takes hold. Investors abandon hope that the stock market will deliver positive returns and they sell. Capitulation often is a sign the market has bottomed, reported Nicholas Jasinski and Jacob Sonenshine of Barron’s. In recent weeks, investors have been selling, but some say the market has not yet reached capitulation.

If you have any questions or concerns about your investment portfolio or recent market events, please don’t hesitate to give us a call.

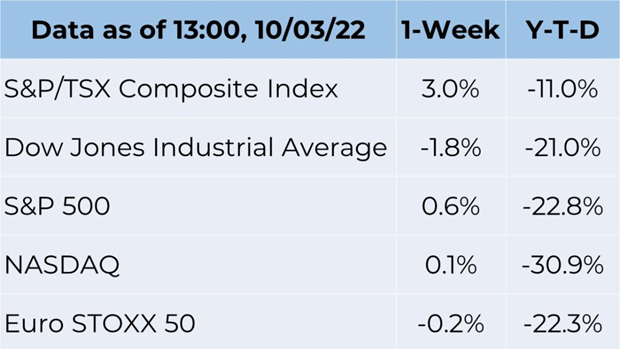

Source: FactSet

Do you like getting paper in the mail? Do you prefer some communication over email rather than mail?

Let us know your communications preferences by filling out this survey below. It should only take you a couple of minutes to fill out!

The Weekly Wrap Up

It was a tumultuous week. In the United States, Hurricane Ian pummeled Florida and South Carolina. Analysts estimate the destruction in Florida will cost U.S. insurance companies about $63 billion, although the cost of recovery will be much higher. “The total economic damage will be well over $100 billion, including uninsured properties, damage to infrastructure, and other cleanup and recovery costs,” according to a source cited by Max Reyes of Bloomberg.

In the United Kingdom, fiscal and monetary policies collided last week. Britain’s new government plans to encourage economic growth with a stimulus package to offset energy costs and big unfunded tax cuts. The government’s fiscal stimulus plan could spark at the same time Britain’s central bank is trying to tamp inflation down. Investors showed their disapproval by selling U.K. government bonds, which are known as gilts. As yields surged, gilts rapidly lost value, imperiling the nation’s pension funds. The Bank of England staged an emergency intervention, calming bond markets by promising to continue its bond purchases, reported Brian Swint of Barron’s.

The war in Ukraine continued to affect food and energy supplies, especially in Europe, driving prices higher. The agreement between Russia and Ukraine that allowed some grain exports to Europe, Asia, the Middle East, and Africa in July and August appears to be in jeopardy. Russia is reconsidering the agreement, and has threatened to reject it, which could exacerbate food insecurity in some countries and drive food prices higher.

Weekly Focus - Think About It

“Earnings don’t move the overall market; it’s the Federal Reserve Board...focus on the central banks, and focus on the movement of liquidity...most people in the market are looking for earnings and conventional measures. It's liquidity that moves markets.”

—Stanley Druckenmiller, asset manager

Best regards,

Eric Muir

B.Comm. (Hons.), CIM®, FCSI

Portfolio Manager

Tracey McDonald

FCSI, DMS, CIM®

Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Financial Advisor

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.