Weekly Market Commentary April 22 2025

Canada Recession Chatter

Canada is staring at two interest rate cuts. That’s the sentiment echoed by some economists amid growing concerns that the economy could plunge into recession, driven by the weight of trade tariffs by the U.S. The

U.S. pausing reciprocal tariffs for 90 days, except for China, has done little to alleviate growing concerns of the economy plunging into recession.

Given that around 80% of its exports go to the United States, Canada is expected to suffer from the uncertain U.S. trade policy and Trump's escalating conflict with China. There is already cause for concern due to recent labour market difficulties and deteriorating company and consumer mood. Economists, in a poll on Reuters, warned the Canadian economy could grow by 1.2% and 1.1% this year and next, respectively. It would be a significant drop from an initial forecast of 1.7% to 1.6% growth.

Last month, the Bank of Canada lowered its main rate to 2.75% for the seventh consecutive month, bringing the total number of reductions since early June to 225 basis points. However, the central bank finds itself in a challenging position due to the recent spike in inflation, which reached an eight-month high of 2.6% in February, well above the middle of the Bank of Canada's goal range of 1% to 3%.

Inflation spiking above the 3% level would leave the Bank of Canada in a difficult position, making it hard to cut interest rates. Likewise, it will be the first time since June that the bank paused rate cuts, following one of the most aggressive rate-lowering cycles.

Meanwhile, new Canadian Prime Minister Mark Carney, a former governor of the Bank of Canada, has clarified that his focus is to unite the country economically and lead it into a new era of prosperity. His primary goal is to break down domestic trade obstacles, enhance national productivity, and significantly invest in essential infrastructure.

Carney contends that Canada has been functioning as 13 distinct economies, and that genuine strength will emerge only when wine from British Columbia, lumber from Nova Scotia, and energy from Alberta can move freely across provincial boundaries. His strategy to eliminate bureaucratic hurdles and establish mutual acknowledgement of qualifications, licenses, and safety regulations seeks to transform Canada into a cohesive, efficient, and vibrant economy.

Meanwhile, Canadian equities were in recovery mode at the start of trading on Monday, as exemptions from U.S. tariffs on key imports lifted market optimism. The country’s main stock index, the Toronto Stock Exchange, rallied by more than 200 points, as investors reacted to reports that U.S. President Donald Trump is developing a new tariff approach.

The reprieve from the U.S. administration helped alleviate growing concerns that the global trade war could plunge the world economy into recession. Canadian tech and energy stocks have been the hardest hit amid the trade war. Last week, the Canadian tech sector was down by about 6.1%, as the energy sector fell 6.6% on crude prices below the $60 a barrel level.

The Markets

All eyes on the bond market.

The scale of the tariffs introduced by the U.S. administration shocked investors, sparking a roller coaster of a week for stock markets. Last week,

U.S. stocks:

- Rallied on a rumour.

- Fell when the rumour was recognized as a rumour.

- Rose when President Trump paused reciprocal tariffs on most countries for 90 days.

- Fell as investors considered how the remaining baseline tariffs (10 per cent on all countries, steel and aluminum tariffs, and 100%+ tariffs on China) might affect companies and economies.

- Rallied after the Federal Reserve assured investors it was prepared to step in, if needed.

“Economic angst enveloped every corner of Wall Street as U.S.-China trade tensions escalated, sparking a slide in stocks, the dollar and oil, with liquidations in U.S. assets pointing to disorder in the financial system,” reported Rita Nazareth, Isabelle Lee, Denitsa Tsekova, and Vildana Hajric of Bloomberg.”

Disorder in the financial system

Some of the disorder was found in the United States Treasury market, where yields were moving higher when many expected them to move lower. Investors who are concerned about risk and sell stocks tend to seek financial shelter in investments that are perceived to be steady in a storm. For many years, United States Treasuries have been a “safe haven.”

So, last week, there was an expectation that, as investors sought shelter from the tariff storm, rising demand would push Treasury yields lower. That wasn’t the case. Investors sold U.S. Treasuries, pushing yields higher, reported Sydney Maki and Carter Johnson of Bloomberg.

“Billed as so rock-solid safe they’re risk-free, U.S. Treasury bonds have long been the first port of call for investors during times of panic. They rallied during the global financial crisis, on 9/11 and even when America’s own credit rating was cut…But this time may be different. As President Donald Trump unleashes an all-out assault on global trade, their status as the world’s safe haven is increasingly coming into question…Yields, especially on longer-term debt, have surged in recent days while the dollar has plunged,” reported David Rovella of Bloomberg.

The Federal Reserve (Fed) soothed the market

On Friday, Minneapolis Fed President Neel Kashkari and Boston Fed President Susan Collins both discussed ways the Fed can “manage a dislocation, or pricing disruption, in the Treasury market…[the moves] are instruments designed to keep markets running smoothly by making sure there is enough liquidity, meaning financial institutions have access to the short-term funding they need to operate,” reported Nicole Goodkind of Barron’s.

Markets were soothed by the assurance that the Fed stands ready to “keep financial markets functioning should the need arise,” reported Stephen Culp of Reuters. By the end of trading on Friday, major U.S. stock indices were in positive territory. Yields on longer maturities of U.S. Treasuries also finished the week higher.

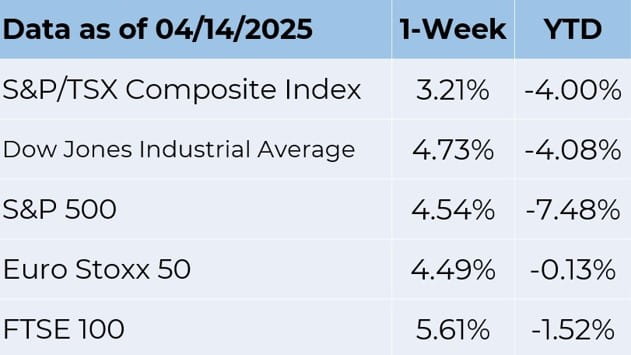

Source: FactSet

What Do You Know About Money?

The United States began using paper money in 1690. The Massachusetts Bay Colony paid soldiers fighting military campaigns against the French in Canada with paper notes. “This was an emergency measure, but it turned out to be a solution to the long-term problem of building an economy without large reserves of precious metals. Eventually, all of the other colonies issued their own bills,” according to Smithsonian Education.

See what you know about the history of American money by taking this brief quiz.

- Ben Franklin printed money for Pennsylvania, Delaware, and New He often included images from nature, such as intricately detailed leaves. What was the primary reason Franklin included nature prints on notes

- The visually pleasing notes attracted customers

- The prints symbolized the growth of the nation

- The prints symbolized money circulating through the economy

- The prints made Franklin’s notes difficult to counterfeit

- When did the era of “lawful money” (the modern era) begin?

- In 1792, when the US mint was created

- in 1893, after a bank panic

- In 1913, under the 1913 Federal Reserve Act

- In 1936, when Fort Knox was built

- United States currency is held as a reserve, and for trade, by many other What percentage of our currency is held outside the United States?

- One quarter

- One third

- Two thirds

- Three quarters

- Some denominations of U.S. paper money wear out faster than others. Which denomination has the shortest lifespan?

- A $1 bill

- A $5 bill

- A $10 bill

- A $20 bill

Weekly Focus – Think About It

“I find television very educating. Every time somebody turns on the set, I go into the other room and read a book.”

–Groucho Marx, Comedian

Answers: 1) d; 2) c; 3) c; 4) b

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.