Weekly Market Commentary May 12 2025

Canada Recession Warning

Canada's business community is bracing itself for a recession, even as the central bank tries to avert the situation. A new Market Participant Survey by the Bank of Canada indicates that the prospect of gross domestic product growth has fallen significantly. As of the end of 2024, the business community expected the economy to grow by 1.8% in 2025.

Faced with the long-term effects of tariffs and a trade war with the U.S., the community has lost confidence in the economy, which they expect to grow by just 1% in 2025. The prospect of the Canadian economy plunging into recession in the next six months has risen to 38% from 26% in the fourth quarter of last year.

The prospect of recession comes on the heels of GDP sliding 0.2% month- on-month in February, in contrast to a 0.4% increase in January. The February figure fell short of what the market had anticipated. Weather- induced weakness in goods-producing sectors was the leading cause of February 2025's decline in real GDP by industry.

February saw a minor fall in service sectors, as a result of contractions in real estate and transportation, while the overall decline was led by the goods-producing industries, which were weakened by mining, oil and gas extraction, and construction. February's monthly GDP grew 1.6% on an annual basis, the lowest since May 2024 and less than January's 2.3% expansion.

Based on Deloitte's estimate, Canada's GDP growth in 2025 is predicted to be well below the historical norm, at little over 1%. High interest rates, inflationary pressures, and uncertainty in the global supply chain have all contributed to a slowdown in consumer demand and a decline in investor confidence.

There has been a discernible drop in private sector investment, particularly in infrastructure and industry. Due to high borrowing rates and unclear policies, many companies are opting to postpone or reduce the scope of significant capital projects.

Geopolitical tensions and uncertainty surrounding North American trade policy are also cited in the report as contributing factors to the decline in foreign direct investment. The election outcome appears to have a minimal impact on the economic outlook. On the other hand, the business community remains weary of trade tensions, which are seen as a major factor that will accelerate the economy's plunge into recession.

Amid the recession fears, newly elected Prime Minister Mark Carney promised to spearhead the biggest transformation of the Canadian economy. He maintains that the immediate focus is on addressing trade pressures and broader future economic growth. Even as the focus shifts to standing up for Canadians against the U.S., Carney reiterates the need to abolish existing trade barriers between provinces.

Meanwhile, Canada stocks remain upbeat, with the main stock index rising to near four-week highs on relief that uncertainty around the general election is in the rearview mirror. The focus is slowly shifting to corporate earnings, which continue to paint a picture of the economy's outlook. Canada's stocks were higher at the close of business last week, driven by gains in the industrial IT and financial sectors.

Nevertheless, the Canadian main stock index, the Toronto Stock Exchange, was under pressure at the start of business on Monday. The index was down by 0.4% to 24,942.81 points. The pullback came when Trump announced a 100% tariff on movies produced outside the U.S.

The Markets

American companies did well in the first quarter.

During earnings season, publicly-held companies tell investors how they performed during the previous quarter, with a particular focus on earnings, which reflect company profits.

Currently, we’re more than halfway through earnings season, and companies in the Standard & Poor’s (S&P) 500 Index have reported solid performance results overall. “Both the percentage of S&P 500 companies reporting positive earnings surprises and the magnitude of earnings surprises are above their 10-year averages," reported John Butters of FactSet.

As of last Friday, 72% of S&P 500 companies had reported earnings, and the blended earnings growth rate was 12.8%. If earnings stay at this level, we will see a second consecutive quarter of double-digit earnings growth for the S&P 500, reported Butters.

While first-quarter earnings were strong, it’s unclear whether future earnings growth will be as robust. “During the month of April, analysts lowered EPS [earnings-per-share] estimates for the second quarter by a larger margin than average…Analysts also continued to lower EPS estimates for [calendar year] 2025,” reported Butters.

The reasons for changing expectations may be related to two words that have been popping up more than usual on earnings calls: “tariffs” and “uncertainty”.

“Several companies noted that the uncertainty surrounding tariffs is making businesses hesitant about investment decisions. That means they are delaying stocking up on inventory (or in some cases, overstocking), hiring, and dealmaking,” reported Sabrina Escobar of Barron’s. “All the uncertainty has made it hard for companies to make accurate projections for the year ahead.”

Last week, major U.S. stock indexes rose. “As of Friday, the S&P 500 index had risen nine days in a row, its longest streak since 2004. It jumped 10.2% in that span – 2.9% of that in the past week – a remarkable performance given the cloud of uncertainty hanging over American businesses,” reported Avi Salzman of Barron’s.

Yields on most maturities of U.S. Treasuries moved higher over the week.

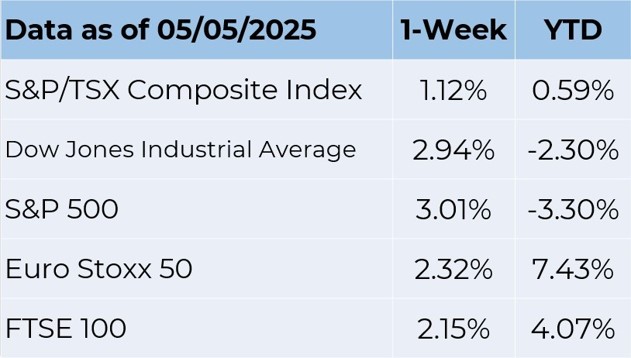

Source: FactSet

Honey, I Shrunk the Economy!

Last week, there were a lot of headlines about the U.S. economy, after the Commerce Department shared information showing the U.S. economic expansion stuttered in the first quarter of this year. From January to March, the U.S. economy contracted, -0.3% annualized, as measured by gross domestic product (GDP) adjusted for inflation.

The reasons for an economic contraction weren’t obvious. Many companies were doing well, and business investment was solid. Consumer spending slowed but remained healthy. Government spending dropped a bit, but the fly in the economic ointment was imports from other countries.

“An enormous surge in imports was the big outlier in this GDP report. Normally, big increases in imports rarely coincide with outright declines in

headline GDP because stronger imports usually mean more spending, not less,” reported a source cited by Megan Leonhardt and Matt Peterson of Barron’s.

Why are imports part of U.S. productivity?

You may be scratching your head, wondering why imports – goods produced in other countries – are included when determining the value of all goods and services produced in the United States. The short answer is: They’re not.

Broadly, U.S. GDP is measured by adding up:

Personal consumption expenditures (consumer spending) Investment (business expenditures, household purchases of homes) Government spending (mandatory and discretionary)

Exports (goods made in the U.S. and shipped elsewhere)

The final step is subtracting imports, which are goods that were made elsewhere. Imports are deducted because they’re in consumption, investment, and government spending numbers. To understand what was produced in the United States, imports must be subtracted. The St. Louis Federal Reserve offered an example of how that works.

“…if $10,000 in imported parts are used in the production of a car in a U.S. factory (an “American” car) and the car is sold in the United States for

$30,000, then the $30,000 counts as personal consumption expenditures; but $10,000 is subtracted to account for the value of the imported parts, so the effect on U.S. GDP is $20,000.”

The GDP report raised some interesting questions

The report about U.S. economic performance raised some questions that have yet to be answered. Why didn’t U.S. GDP reflect the purchase of imports? What happened to the imported goods? It’s possible the surge in imports was overestimated. It’s also possible spending and investment were underestimated, opined the source cited by Leonhardt and Peterson.

We may have answers over the next two months. Last week’s report was the first estimate of economic growth, and it may have included data that was incomplete or will be updated. We’ll see two more estimates

before the end of June.

For now, it may be enough to know that first quarter GDP appears to reflect “the anticipated impact of tariffs rather than an actual downturn,” as Randall Forsyth of Barron’s reported.

Weekly Focus – Think About It

“It's funny: I always imagined when I was a kid that adults had some kind of inner toolbox full of shiny tools: the saw of discernment, the hammer of wisdom, the sandpaper of patience. But then when I grew up I found that life handed you these rusty bent old tools - friendships, prayer, conscience, honesty - and said 'do the best you can with these, they will have to do'. And mostly, against all odds, they do.”

– Anne Lamott, Author

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.