Weekly Market Commentary - August 11th, 2023

The Markets

Last week, Fitch Ratings startled markets by lowering the credit rating of United States Treasuries from AAA to AA+. It was the second rating agency to downgrade U.S. Treasuries; Standard & Poor’s cut its rating to AA+ in 2011, reported Benjamin Purvis and Simon Kennedy of Bloomberg.

The decision to lower the rating was not a comment on the strength of the U.S. economy, which expanded faster than expected in the second quarter on the strength of business investment in equipment, particularly transportation equipment, reported Erik Lundh of The Conference Board.

While many were baffled by the decision, as well as its timing, Fitch had warned it was considering a rating downgrade in May when lawmakers were haggling over the debt ceiling while the possibility of default loomed, Bloomberg reported.

Last week, Fitch Senior Director Richard Francis told Davide Barbuscia of Reuters, “Fitch downgraded the U.S credit rating due to fiscal concerns, a deterioration in U.S governance, as well as political polarization […]”

There are now 10 countries with government bonds that are rated AAA by at least two rating agencies: Canada, Germany, Denmark, Netherlands, Sweden, Norway, Switzerland, Luxembourg, Singapore, and Australia, reported Tania Chen of Bloomberg.

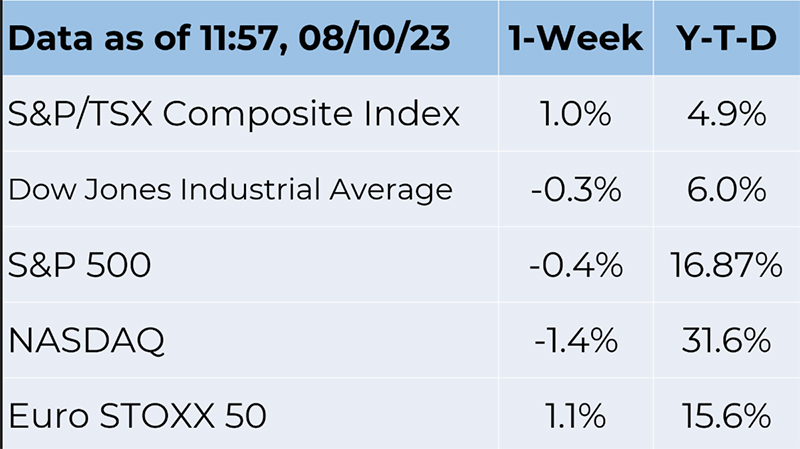

Markets did not take the downgrade well. Stocks sold off, and Treasury rates rose mid-week. Jacob Sonenshine of Barron’s reported:

“Of course, the [stock] market always needs a reason to fall, and this past week it found one in surging Treasury yields. It’s hard to tell exactly what made them pop. Though some blamed Fitch’s downgrade of the U.S. credit rating to AA+ from AAA, it’s more likely a combination of massive issuance—the Treasury said it plans to issue more debt than had been expected—and solid economic data that forced market participants to reconsider their growth targets. Higher yields make stocks worth less, all else being equal.”

At the end of the week, major North American stock indices were lower. Yields on longer U.S. Treasuries rose more than yields on most shorter-term Treasuries. In Canada, Treasury bill yields increased while Government of Canada bond yields fell.

Fundraiser: We've raised over $800!

WHAT ARE BONDS?

Bonds are loans that investors make to governments, companies and other entities. When an investor buys a bond, they agree to lend their money for a specific period of time. In return, the issuer of the bond agrees to pay interest and return the investors’ principal when the bond matures.Bonds are a part of many investment portfolios because they:

1) Offer a source of income, and

2) Help manage overall portfolio risk.

Generally, bonds are thought to be safer than stocks; however, they are not risk-free. Bonds have interest rate risk, which means the value of a bond changes over time, depending on how attractive its interest rate is to investors. For example:

Bond values fall when rates rise. If interest rates move from three percent to five percent, and new investors will earn a five percent interest, then the value of bonds offering 3 percent are likely to drop. The opposite is also true.

Bond values rise when rates fall. If interest rates move from five percent to three percent, and new investors will earn a three percent rate of interest, the value of older bonds offering a five percent return are likely to increase.

The risk and reward profile of a specific bond depends on a variety of factors, including:

The length of time until the bond matures. When a bond “matures,” the issuer is expected to repay the money it borrowed. Maturities may range from one month to 30 years. Bonds with shorter maturities tend to pay less interest because the chance that interest rates will change significantly is lower.

The creditworthiness of the borrower. Creditworthiness reflects whether the borrower is expected to pay interest and return principal in a timely way. Independent rating agencies – Fitch, Standard & Poor’s and Moody’s – review the financial and credit histories of governments and companies issuing bonds, and then assign ratings. There are two broad rating categories:

· Investment grade (AAA/highest quality, AA/high quality, A/strong quality and BBB/medium investment grade), and

· Below-investment grade (BB/low investment grade, B/highly speculative, CCC/substantial risk, CC/high probability of default, C/default in process and D in default).

Weekly Focus – Think About It

“There is nothing either good or bad but thinking makes it so.”

—William Shakespeare, playwright

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.