Weekly Market Commentary - February 23rd 2023

The Markets

Brace for a bumpy ride.

There were some unwelcome surprises in last week’s economic data that caused markets to reassess expectations for 2023. For example:

Inflation didn’t fall as fast as expected. Last week, the Consumer Price Index showed inflation rose 6.4 percent, year-over-year, in January for the United States, and 5.9 percent for Canada over the same period. That was an improvement over December’s pace and the seventh consecutive month of falling prices on both sides of the border, but American economists expected price increases to slow more quickly, reported Megan Cassella of Barron’s.

“Look into the details, and it is easy to see that the inflation problem is not fixed. America’s ‘core’ prices, which exclude volatile food and energy, grew at an annualized pace of 4.6 percent over the past three months, and have started gently accelerating. The main source of inflation is now the services sector, which is more exposed to labour costs…It is hard to see how underlying inflation can dissipate while labour markets stay so tight,” reported The Economist.

Consumer spending accelerated. Retail sales, which is a proxy for consumer spending, rose 3.0 percent in January after declining in November and December of last year, reported the U.S. Census Bureau (Canada’s retail sales data lags behind American data and has not been released yet).

Bullish sentiment in stock markets has been supported by the idea that inflation will continue to slow, and central banks will be able to ease up on interest rates, reported Al Root of Barron’s. Last week, The Economist suggested stock markets may be overly optimistic. “Investors are pricing stocks for a Goldilocks economy in which companies’ profits grow healthily while the cost of capital falls…This is a rosy picture. Unfortunately, as we explain this week, it is probably misguided. The world’s battle with inflation is far from over.”

Bond markets were less sanguine. After a chorus of Federal Reserve officials took the stage to let everyone listening know the federal funds rate would likely need to move higher – and stay higher – for longer, the bond market capitulated, reported William Watts of MarketWatch. As expectations shifted, the yield on a six-month U.S. Treasury moved above 5.0 percent for the first time since 2007 and the yield on ten-year U.S. Treasuries and Government of Canada bonds hit new highs for the year.

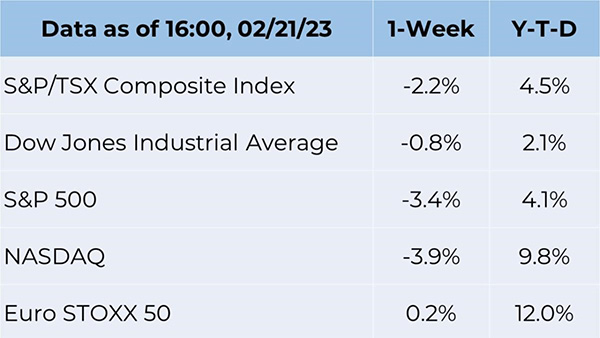

Most major North American stock indices finished the week down. The S&P 500, S&P/TSX Composite and Dow Jones Industrial Average all moved lower, while the Nasdaq Composite finished slightly higher.

Source: FactSet

Upcoming Events:

Gardening Workshop - March 9th

Significant New Trends and New Plants in 2023 - Brian Minter

Estate Planning - April 2023

Effective Estate Planning - Raymond James Trust

Fundraiser:

What do you value the most?

The 2022 Modern Wealth Survey, which is conducted for Charles Schwab by Logica Research in the United States, asked whether personal values are more important to life decisions than they once were. The majority said yes.

“Almost three-quarters of Americans (73%) say their personal values guide how they make life decisions more today than they did two years ago, and nearly an equal number (69%) say that supporting causes they care most about are a top consideration when it comes to their financial decisions…When asked which personal values are their biggest motivators, Americans prioritize doing what’s best for others, including the environment and the greater good as well as their family and friends, followed by saving more and reducing unnecessary spending.”

Defining and prioritizing values takes time and can be a challenging exercise. The Good Project, a research initiative at the Harvard Graduate School of Education’s Project Zero, offers an online value sorting activity. Visitors review a list of 30 values and choose ten to begin. The list includes options like:

• Fame and success,

• Courage and risk taking,

• Creativity and originality,

• Power and influence,

• Hard work and commitment,

• Faith,

• Pursuing the common good,

• Recognition in your field, and

• Solitude and contemplation.

A majority of each generational group that participated in the Modern Wealth Survey agreed that values affect their investment choices: 68 percent of Baby Boomers, 73 percent of Gen X, 75 percent of Millennials, and 82 percent of Gen Z.

Overall, “When looking at the factors that influence investing decisions, a company’s reputation (91%) and its corporate values (81%) are almost as important as more traditional factors like a company’s performance (96%) and its stock price (93%). As personal beliefs and interests become more important, many investors (84%) are also interested in having a more personalized investment portfolio.”

When you think about money and investing, what is important to you?

Weekly Focus – Think About It

“For me, I am driven by two main philosophies: know more today about the world than I knew yesterday and lessen the suffering of others. You'd be surprised how far that gets you.”

—Neil deGrasse Tyson, Astrophysicist

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager